The insurance claim game

Your doctor submitted a claim - now what?

You know the drill.

Go to the hospital. Get recommended for procedures/scans/tests.

Wait for insurance to tell you whether it’ll be covered or not.

Get procedures/scans/tests done.

Wait to see if you’re going to pull your hair out because of a surprise bill dropped on your head.

The sad reality of healthcare today is it’s a battle between providers, insurance companies, and patients to figure out how much care will cost.

Today we’re going to shed some light on the inner workings with a short primer on insurance claims processing (exciting!).

We’ll cover what claims actually are, how they’re processed, weird game mechanics, and startups we’ve seen in this space.

Claims 101

When you think of an insurance claim you might think of a receipt - you have line items with associated costs sent to an insurance company.

But an insurance claim is better thought of as a proposal.

It’s a case the provider puts together for an insurance company to convince them that they should cover your medical costs.

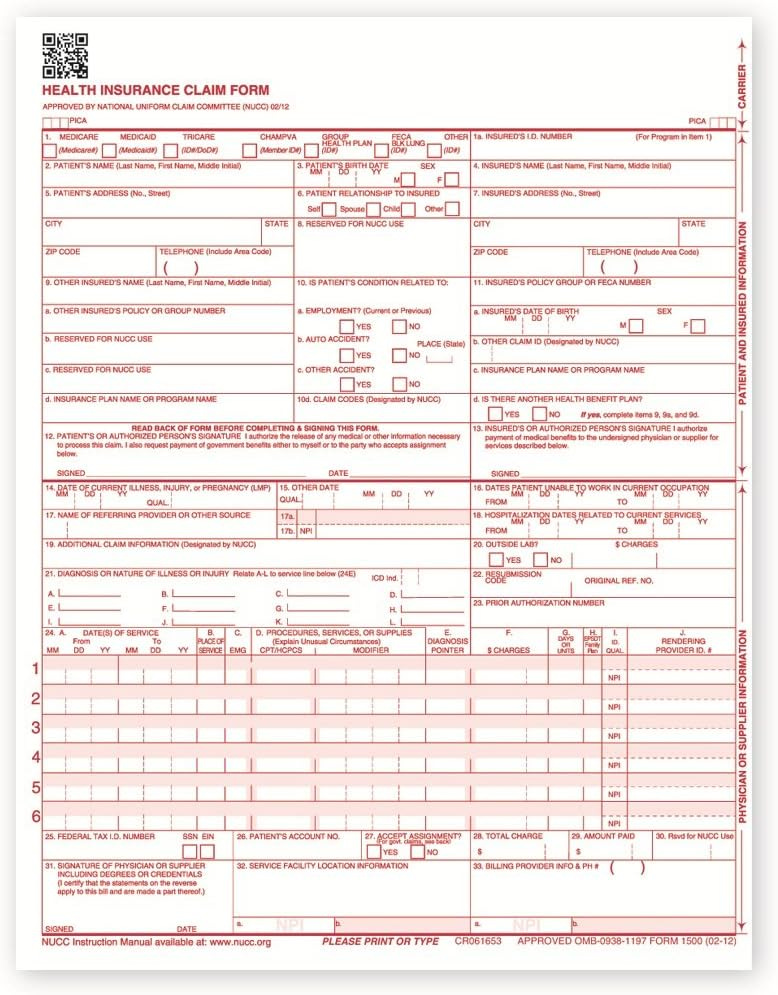

And this case has multiple parts:

Patient info (personal details, medical history, etc.)

Policyholder info (if it’s different from the patient - applicable to family plans)

Provider info

Insurance info

Service details

Medical codes

Patient condition codes (ICD-10 codes)

Procedure codes (Current Procedural Terminology or Healthcare Common Procedure Coding System codes)

Charges (line items of services administered and the associated costs)

Additional supporting documentation

This information collection starts before, during, and sometimes after you’ve received care.

And this is a part of a larger process called revenue cycle management (RCM).

RCM = Getting money from insurance

Everyone who accepts insurance has to execute RCM well to play the insurance reimbursement game.

Ideally, it shouldn’t be a game, but more on that later.

RCM can be broken down across 3 parts.

The front-end, middle, and back-end.

The front-end

This is where all your personal info is collected, main purpose is just to make sure you’re eligible. Involves two steps:

Pre-registration

Patient information collection

Verifying patient’s insurance coverage and benefits to figure out eligibility and financial responsibility (this is only an estimate)

Registration

Patient check-in for service

Obtaining consent and authorization for treatment

The middle

This is the meat of the provider’s work.

When an encounter (when a provider sees a patient) happens, they’re trying to take care of their portion of RCM:

Charge capture

Recording services provided to patient (procedures, treatments, and supplies) and assigning appropriate medical codes to services

Claim submission

Compiling all necessary information and documentation to create a claim, including patient details, provider information, service codes, and charges and submitting electronically or by paper (fax machines!!) to insurance

Each insurance company has different rules/preferred methods of submissions

The back-end

After insurance has processed the claim, they’ll send some stuff back for the provider to review. Things like whether the claim was accepted/denied, outstanding balance, etc.

Usually there will be some sort of revenue team that deals with these parts of RCM:

Payment posting

Receiving and processing payments from insurance companies and patients and post to the patient accounts w/ relevant adjustments

Takes into account contractual allowance, copay, and deductible

Contractual allowance => difference between the provider billed amount and how much insurance has agreed to pay based on contract w/ provider

Ex. a provider bills $200 for a service, but the contracted rate with the insurance company is $150, the $50 difference is the contractual allowance

Ex. w/ adjustments

Provider Billed Amount: $500

Contractual Allowance: $150 (negotiated discount)

Adjusted Amount: $350 (billed amount minus contractual allowance)

Insurance Payment: $280 (80% of the adjusted amount, assuming 20% coinsurance)

Patient Responsibility: $70 (20% coinsurance) + copayment + any applicable deductible

Claim management

Address and resolve any denied or rejected claims from insurance by identifying the reasons for denial, correcting errors, and resubmitting the claims

Patient Collections

Billing patients the remaining amount and determining payment plans (if patient can’t pay it back all-at-once)

This process seems pretty straightforward and if done well should result in all insurance claims being paid.

But you know that’s far from the truth.

The Game

The requirements for a game are as follows:

Clear win/loss condition

Rules

A challenge to be overcome

Insurance claims processing has all of these.

Win condition → Insurance companies win when they don’t have to pay out claims and get to keep more of the insurance premiums paid to them. Healthcare providers win when they get reimbursed more.

Rules → The rules are sending and processing a well put together claim reflecting patient care.

Challenge → The challenge is getting money (for hospitals) vs keeping money (for insurance plans).

As you can imagine both parties don’t play nice.

Just take for example how insurance companies process claims:

When an insurance company gets a claim they do claim adjudication

They review the claim to ensure it has all the necessary info

Verify patient eligibility for coverage and services provided are covered under the patient’s plan

Ensure that the procedure was actually necessary for the patient

Checks for right medical codes

And then will calculate proper pricing based on benefits

This process is weird for a couple reasons.

It reminds us of the tax system. The IRS knows how much you should pay but makes you do the work of inputting all the data to figure it out.

Why would an insurance company that knows the right medical codes and modifiers check that you submitted the right medical codes as opposed to auto-assigning them? Because it allows them to deny claims.

Why would an insurance company ensure the procedure was necessary for the patient after-the-fact? Because it allows them to deny claims

Another weird thing is most claims are auto-adjudicated:

85% of claims are auto-adjudicated by software (no humans see them) because it costs $20 for a human to review a claim

If it gets through an initial automated check and it seems like the insurance will pay the claim there’s a secondary audit that’s kicked off (this doesn’t happen often)

In some cases if the claim is < $10K-$15K, the carrier will just let the claim pass through because it’s so expensive to do manually

This allows for a lot of fraud and abusive spending -> 3%-10% of healthcare spend is fraud

This is bad because bad claims might be paid for by insurance and this could increase insurance costs for employer/individual

And healthcare providers also try to exploit loopholes, mainly through processes like up-coding (adding an inaccurate medical code to increase reimbursement).

The rationale being “If this claim is going to be auto-adjudicated if it’s less than $10K, why not just charge up to that limit?”

But to combat this, insurance companies use maneuvers like prior authorizations.

Prior authorizations are approvals from insurance required before administering certain medications or procedures. So if you need a procedure that requires prior auth, your provider will have to submit a case explaining why you need it.

Which leads to a ton of paperwork, so sometimes (usually in the cases of meds) the provider might just choose the service which doesn’t require prior auth approval.

Tech Innovation

A lot of processes we’ve mentioned here (RCM, prior auth, etc.) are highly manual right now. They also take away time from practitioners to focus on patient care.

Advances in OCR (optical character recognition) + LLMs (tech behind ChatGPT) allows for automating a lot of it. Which seems pretty straightforward, but anyone who has dealt with integrating with insurance plans will tell you a different story.

But the market opportunity is quite lucrative. Every healthcare business that deals with insurance is trying to increase the reimbursement rates.

And for reference one of the biggest players in the space, R1 RCM, does $1B+ in annual revenue.

Combining the technical inflection and market opportunity makes this a ripe problem space for startups to go after.

Here are a handful we’ve come across:

Candid Health - RCM automation for digital health companies

Fay - Automating billing and insurance operations for dietitians and nutritionists

Alma - Helping mental health practices with billing and insurance operations

Silna Health - Prior auth for autism, physical therapy, and speech therapy practices

Juniper - Billing and insurance operations for health & physical therapy practices

Cohere Health - One of the current leaders in prior auth automation

A recurring pattern is taking the same approach (handling billing/insurance/prior auth) and applying it to a different specialty (mental health/nutrition/etc.).

This seems to be a winning model (highlighted by Derek Flanzraich in his newsletter).

But on the flip-side, this is just an opportunity to streamline the process. Not to fix the underlying incentives.

So how can that be done? Through precision medicine.

Precision medicine is a fancy way of saying you’re tailoring care specific to a patient biological data (genetic profile, glucose levels, hormones etc.).

If this sounds too sci-fi, bear with us.

A lot of the game theory dynamics in healthcare arise from subjective care.

Care is based on the doctor’s judgement on the treatment needed, and the insurance company decides if they agree.

An example to illustrate is drug prescription.

When you get prescribed medication and dosages, the doctor’s making a guess that this will work for you.

And if it doesn’t? Well you’ll just keep tinkering with the dosage and the drug till it does work. Guessing and checking until landing on the right solution.

In an ideal world you should have continuous monitoring of your vitals, hormones, blood/glucose levels, etc. so the dosage is as accurate as possible for your biological makeup. And you can also see in real-time how the drug is affecting you.

If someone solves this holy grail of healthcare, it makes the system better for everyone.

Insurance has less wiggle room to deny the potential outcomes and reject claims

Patients get the care as specific to their condition as possible

With increasing patient data you can provide more preventative care

Some companies we think are interesting in this space are:

Synex - Non-invasive metabolite (glucose, lactate, etc.) monitoring

Eli - Real-time hormone testing

Superpower - Biomarker testing and analysis

Founders bringing the sci-future of precision medicine to reality makes us more optimistic about the future of healthcare and humanity!

If you made it this far, thank you for reading.

We’re always looking to learn from others, so if you have any thoughts please feel free to reach out.

And if there’s anything you were curious about or think we should modify/add let us know!

Great article. For your research you can also look into a few other issues

1 - not all docs bill the same. This lack of billing knowledge means docs doing the same exact thing can make vastly different amounts, especially if you extrapolate that over their career

2 - further down the chain of care you have PBM which are like the mafia and get to decided to get what’s drugs and what cost, behind closed doors

3 - docs know that insurance will counter so they give a higher bill (claim), especially with Medicare/medicade, which results in a messy process which is often not profitable for hospitals

4 - the burden of pressure on docs having to change their treatment pattern to follow insurance rules so they get reimbursed. Aka, why the hell does insurance get to decide the treatment algorithm.

Overall, great work with this one, excited to continue reading.

Hey! This is a great article explaining RCM in the medical industry. I like how you split RCM into 3 parts and listed the short-term tech solutions and long-term medical-focused solutions for RCM issues. One thing that would make it better would be to add a pie chart when explaining contractural allowance. It would make it easier to visualize. Overall, its a good article👍